Featured M&A - In the News

My Blogs - Recent

Top Trends in Insurance M&A in Australia 2025: Summary

Australia's Insurance M&A: The 2025 Outlook Australia's insurance sector is in a period of strategic reinvention. M&A is no longer just about growth; it's a vital tool for navigating digital disruption and regulatory scrutiny. Drawing from leading reports, key trends for 2025 include the rise of AI-powered dealmaking, which enables faster due diligence and more accurate valuations, particularly for insurtech targets. There's also a heightened focus on regulatory due diligence to address the widening trust gap, as well as the increasing importance of ESG metrics in deal evaluation. Insurers are actively rationalizing their portfolios, divesting non-core assets to focus on

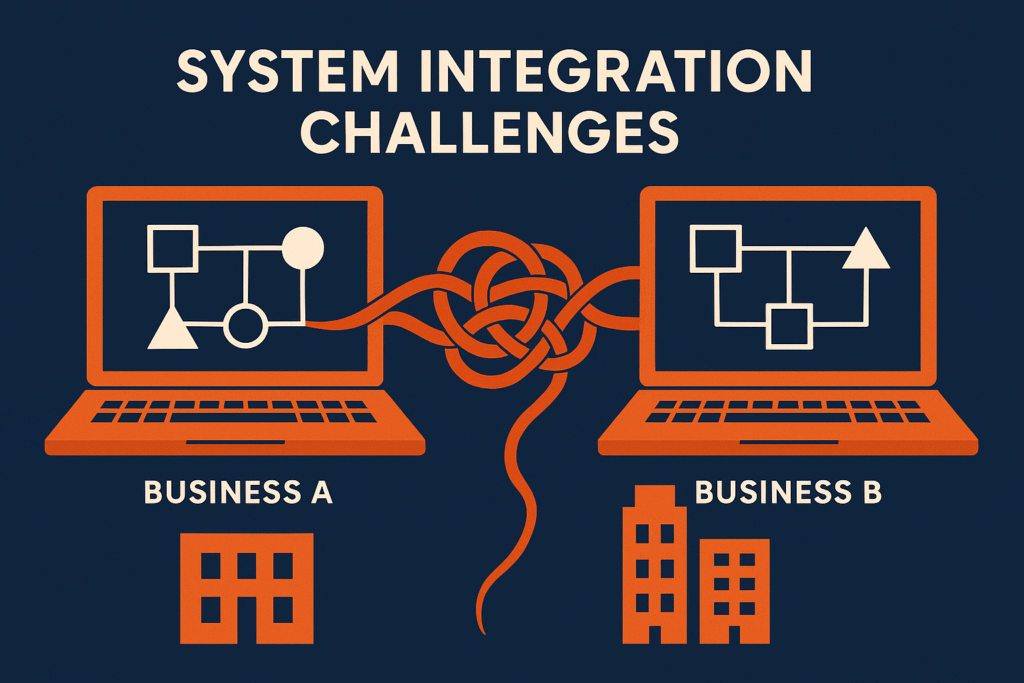

Untangling the Acquisition Tech Knot

Mergers and acquisitions offer strategic growth opportunities, but integrating newly acquired systems poses significant challenges—especially in financial services. This article explores the complexities of system incompatibility and data migration, highlighting how legacy technologies, manual processes, and security vulnerabilities can derail integration efforts. Drawing on experience from four M&A programs, it outlines key risks such as incompatible software, user-defined applications, and AI-related disruptions. Effective planning, early risk identification, and robust data management are essential to avoid delays, cost overruns, and operational breakdowns

Bridging the Gap: Cultural Integration in a PMI

Cultural integration is crucial in PMI (Post-Merger Integration) as it lays the foundation for a harmonious and cohesive organisation. It brings together the values, beliefs, and work ethics of the merging companies, fostering better collaboration and alignment among teams.